Let’s Verify you

3 Ways To Authenticate

Why do we authenticate?

Simply to protect you and your data. The authentication process is designed to ensure that only you can access your data.

We offer 3 ways to authenticate yourself and they are relatively easy as long as you take with the process.

Licence and Medicare

We can use your license and medicare cards, please note: That this is a 2 step process and you will need both a driver’s licence and Medicare card to authenticate via this process. Whilst easy, you need to be exact so read more below

ATO Known Information

You can answer questions that only the ATO and yourself would know, although there is a need to ensure your ATO is up to date. There are some key steps to using this process, please read more below

Manual Verification

We can arrange a video meeting with one of our representatives, at this meeting you would need to provide supporting information including something with your photos such as a Passport or License and other forms of ID. Read more below

Getting Started

Hints and tips on getting started can be found here

Can’t Find Your Tax File Number?

Here is a quick guide on where to find your Tax File Number. Click Here

What can I claim?

Here is a cheat sheet on some of the claims available. Click Here

Occupational Deduction Guides

Not sure what you can deduction, here is a list of occupational deduction guides to help

Click Here

Authenticate yourself with a Drivers License and Medicare cards

In order to be authenticated by this process, you will need both a current license and a medicare card.

If either of these cards is out of date the process will fail.

Drivers License

READ CAREFULLY

Please ensure to enter your

- Birth Date

- Given Name (First Name)

- Family Name (Last Name)

- State of Issue

- License Number

- Card Number (if requested)

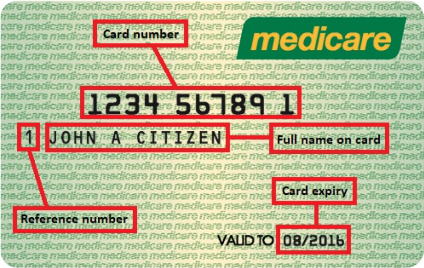

Medicare Card

READ CAREFULLY

Please ensure to enter your

- Exact name as per the card

- The expiry month and year

- The card number

- Your reference number, this is the number next to your name on the card

Authenticate yourself with your personal data

In order to be authenticated by this process, you will need to first check that your data is up to date in the ATO system. A common problem people have is they have out-of-data phone numbers and addresses from when they first lodged or even their last tax agent has his details in there. Remember, the data in there is likely to be the original data and this is different to MyGov data and not connected.

Check your details are correct with the ATO details

Step 1.

Simply log in to you MyGov Account by going here https://my.gov.au/

A range of services can be linked to your MyGov account including your ATO Information.

Step 2.

Check to see if your Ato Services are connected, if not simply click on the services tab and link ATO Services. This should now connect your ATO services to your MyGov account and show on the main screen each time you log in

Step 3.

Click on your ATO services icon, once open, go to my profile and you will find your TFN and personal details, Scroll down the page and ensure your mobile and postal details are correct as these may be used to authenticate you when logging into the Refunded App

Authenticate yourself with a video call

Refunded also offers you the ability to have manual verification.

What’s involved in manual verification?