How does Refunded work?

Refunded allows you to control your tax return process. You cannot be expected to work a busy life and then suddenly be ready because you booked a meeting with a tax agent. How many tax questions have you been asked where you wished you had more time to think about it? Things like

- What’s my starting position for my tax return?

- Do I have to claim?

- Should I claim?

- Can I adjust my claims as I find them?

- What are the Australian tax deductions I can make?

- What’s my job title listed as with the tax department?

- Complex questions that are simpler than you think.

What’s my starting position for my tax return?

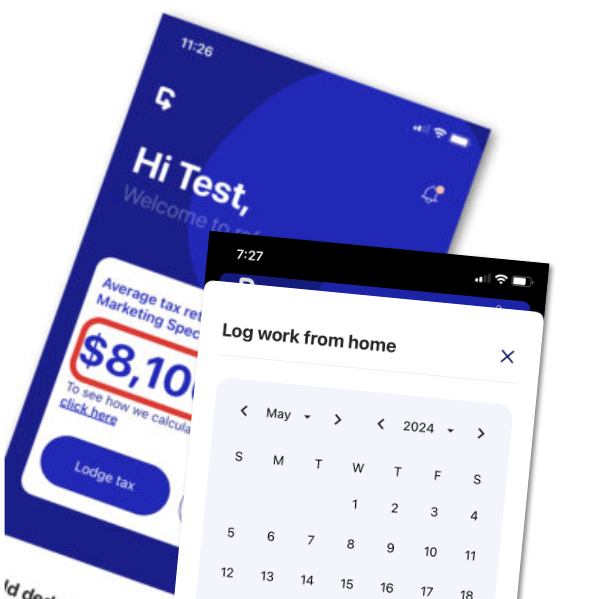

Refunded is perfect for seeing what your starting position is, free of charge you can add in your details and you will be shown what the government this you are owed or owe. A perfect place to start looking at your tax and making sure you are achieving the best result for yourself.

Do I have to claim?

No, in fact in a lot of cases people don’t have anything to claim and this really highlights the power of Refunded. Simply add your personal details in, your tax file number and you will be presented with your prefill information from the ATO and you will see if you are entitled to a tax return without having to claim. Remember, if you have to pay, you will not be charged to submit your tax return, after all why pay an accountant to have to pay.

Should I claim?

As long as you are entitled to a deduction according to the rules of the Australian Tax Office then the question is more about whether you want to. Some people just couldn’t be bothered and would rather just square up with the Tax office and get on with life, Refunded can help you do this in the quickest way possible.

Other people like to make sure they are minimising their tax and Refunded allows them the time to go away and research, collect their receipts, ensure they are in the best position before submitting their tax return.

Can I adjust my claims as I find them?

As long as you adjust your claims before the final submission. This is the power of Refunded, you can continue to work on your claims until you are completely satisfied. Take your time, research your options, then submit when you are ready.

What are the Australian tax deductions I can make?

There are wide range of deductions available to Australian Citizens if you match the criteria. Refunded will help you were it can however if you tax becomes complicated we will offer to pass your details on to one of the accountants we have identified as registered tax accountants.

You may be able to claim a deduction for expenses that directly relate to your work, including:

- Vehicle and travel expenses

- Clothing, laundry and dry-cleaning expenses

- Home office expenses

- Self-education expenses

- Tools, equipment and other assets

- Other work-related deductions

Other deductions: You may also be able to claim a deduction for:

Not sure, then visit the ATO website and search any of these subjects

- ATO interest – calculating and reporting

- Cost of managing tax affairs

- Gifts and donations

- Interest charged by the ATO

- Interest, dividend and other investment income deductions

- Personal super contributions

- Undeducted purchase price of a foreign pension or annuity

What’s my job title listed as with the tax department?

Refunded will provide you with a list of job titles to select from when you start to claim, this are the official job titles the tax department has provided so you should have no problems in selecting your Job title. The ATO also provides a list if you are unsure.

Am I an Australian Tax Resident for tax purposes.

You probably are, were you born here? do you work here? Here is what the Australian Tax Office says.

Generally, we consider you to be an Australian resident for tax purposes if you:

- have always lived in Australia or you have come to Australia and live here permanently

- have been in Australia continuously for six months or more, and for most of that time you worked in the one job and lived at the same place

- have been in Australia for more than six months during 2019–20, unless your usual home is overseas and you do not intend to live in Australia

- go overseas temporarily and you do not set up a permanent home in another country, or

- are an overseas student who has come to Australia to study and are enrolled in a course that is more than six months long.

If you need help in deciding whether or not you are an Australian resident for tax purposes, we have online tools to help you. For more information, see the ATO website and search for residency.