Click Play on this video for a quick introduction

Refunded is deisgned to be intuitive and this video will show you in a minute how simple it can be, including the wonderful (often free) features we offer.

Ready start, here is a few things you should consider

Important things to know. The app saves as you go along, so you can come back at any time and restart and all your data will be there. The app is free to use, until you submit your tax return, and if your the tax man, we will submit your return for free.

Not sure what your tax file number is, Click Here for help

Personal Information

What you will need

Refunded works with the ATO directly, however you will need to provide this information to the ATO to complete the login process. In order to do this you will need the following

- Your Full Name

- Your Tax File Number

- Date of Birth

You can now chose one of 2 methods to identify yourself

- Information linked to your ATO account

- Drivers Licence and Medicare Card

Identifying yourself through your license and medicare is the simplest way. If you choose to use your ATO account information to log in, please check your information is in your ATO account and not your tax agent. To check your information is accurate, Click Here

Not sure what you can claim? we have plenty of help on the website to help.

Common Deductions

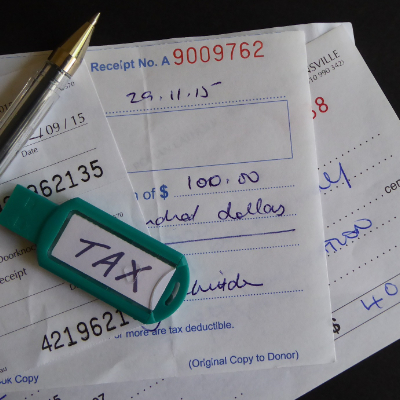

Receipts, notes and calculations

Before starting, you should collate the information you may require around any claim or deduction. Deductions will generally require you to have receipts associated with the claim, some may require proof of calculations. So what can you claim? This varies depending on your role and the situation,

Other Deduction Types

Other deductions: You may also be able to claim a deduction for:

WANT HELP?

Refunded is designed for people with non-complex tax requirements but we can also help you if you need an accountant. If you want help, simply use our contact form and we will try our best to help you.