If you have a spouse or started a defacto relationship throughout the tax year, you will need to provide your spouses taxable income. In order to calcuate this income, the ATO provides a checklist and caculation method.

To use the caluculation method, you will need the following information for your spouse

- First Name

- Middle Name (if applicable)

- Last Name

- If the relationship was for the whole year?

- If not then how many months

- Their taxable income

- Trust Income

- Any fringe benefits

- Pensions and or allowances

- Any superannuation contributions

- Any foreign income

- Child support paid

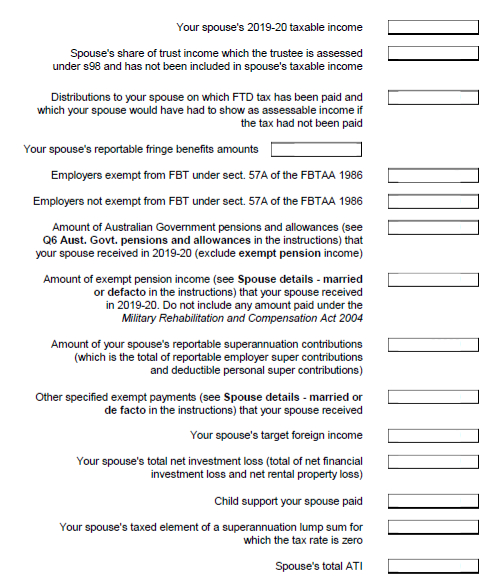

Shown is an snippet from a tax form that highlights what is considered income and what should be calculated. If you are not sure that seek help from an accountant.

Here is a link to a page on the ATO that may help?

myTax 2021 Spouse details

Complete this section if you had a spouse during 2020–21.

On this page:

Things to know

Including your spouse’s income is important as we use it to work out whether you:

- are entitled to a rebate for your private health insurance

- are entitled to the seniors and pensioners tax offset

- are entitled to a Medicare levy reduction

- must pay Medicare levy surcharge.

Your spouse includes another person (of any sex) who:

- you were in a relationship with that was registered under a prescribed state or territory law

- although not legally married to you, lived with you on a genuine domestic basis in a relationship as a couple.

Completing this section

If you had more than one spouse during 2020–21, complete this section with the details for your last spouse in 2020–21.

You will need details of your spouse’s income.

If your spouse has lodged their return, you can obtain income details from the completed return.

If your spouse has not lodged their return or does not need to lodge a return, income details can be obtained from:

- their income statement or PAYG payment summary – individual non-business

- relevant distribution statements for any trust income and any family trust distribution tax

- if your spouse had child support obligations, details of the amount of child support they paid (your spouse can get this information from Services Australia)

- if they received foreign income, details of the amount of foreign income received

- if they had financial investment losses, the net financial investment loss amount

- if they had rental property losses, the net rental property loss amount

- if they claimed a deduction for personal superannuation contributions, details of the amount claimed.

Seek the information required at this section from your spouse, whether or not they need to lodge a tax return. The ATO is not able to disclose details of your spouse’s income, even with your spouse’s consent.

If you can’t find out any of the amounts required, you can make a reasonable estimate. You will not be penalised for an incorrect estimate if you acted reasonably and in good faith.

We pre-fill your tax return with your spouse’s other details from your 2019–20 tax return (if you had a spouse on 30 June 2020). Check spouse details and update, if necessary.

To personalise your return to show spouse details, at Personalise return answer Yes to the question ‘Did you have a spouse at any time between 1 July 2020 and 30 June 2021?’.

To show your spouse details, at Prepare return select ‘Add/Edit’ at the Spouse details banner.

At the Spouse details heading:

- Enter your spouse’s personal details into the corresponding fields.

- Your spouse’s gender is important for assisting us to correctly identify your spouse. Select Male, Female or Indeterminate. Indeterminate refers to any person who does not exclusively identify as either male or female, for example, a person of a non-binary gender. A person may use a variety of other terms to self-identify.

- If your spouse died during 2020–21 and you did not have another spouse on or before 30 June 2021, answer Yes to the question Did your spouse die during the year, and you did not have another spouse on or before 30 June 2021? This information is used to calculate your Medicare levy surcharge.

- Enter your spouse’s income and other details into the corresponding fields. If the amount is zero, enter 0.

- Select Save and continue when you have completed the Spouse details section.

Spouse’s income and other details

Your spouse’s taxable income

You will usually find this amount on your spouse’s tax return or notice of assessment.

If your spouse received any assessable First home super saver released amount, exclude it from the amount you enter at Your spouse’s taxable income.

If your spouse’s taxable income (excluding any assessable First home super saver released amount) is zero or a loss, enter 0.

Seek this information from your spouse, whether or not they need to lodge a tax return. The ATO is not able to disclose your spouse’s taxable income, even with your spouse’s consent.

If you can’t find out your spouse’s taxable income, you can make a reasonable estimate. You will not be penalised for an incorrect estimate if you acted reasonably and in good faith.

Your spouse’s share of trust income on which the trustee is assessed and is not included in your spouse’s taxable income

Check the trust distribution statements and enter the amount any amount of net income of a trust that the trustee was liable to pay tax on because your spouse was under a legal disability, for example, they were a person who:

- was bankrupt

- was declared legally incapable because of a mental condition, or

- was under 18 years old on 30 June 2021.

Do not include any amount already included in Your spouse’s taxable income.

Amounts received by your spouse on which family trust distribution tax has been paid

Check the trust distribution statements and enter the total distributions to your spouse:

- on which family trust distribution tax has been paid, and

- which they would have had to show as assessable income if the tax had not been paid.

Your spouse’s total reportable fringe benefits amounts

From employers exempt from FBT under section 57A of the FBTAA 1986

Enter the amount shown at Employers exempt from FBT under section 57A of the FBTAA 1986 at Total reportable fringe benefits amounts (in the Income tests section) on your spouse’s tax return.

From employers not exempt from FBT under section 57A of the FBTAA 1986

Enter the amount shown at Employers not exempt from FBT under section 57A of the FBTAA 1986 at Total reportable fringe benefits amounts (in the Income tests section) on your spouse’s tax return.

Your spouse’s Australian Government pensions and allowances

Enter the amount of Australian Government pensions and allowances that your spouse received in 2020–21 (not including exempt pension income). Australian Government pensions and allowances are listed at Australian Government payments such as pensions and carer payments.

Your spouse’s exempt pension income

Enter the amount of any of the following exempt pension income that your spouse received in 2020–21.

- disability support pension paid under Part 2.3 of Social Security Act 1991

- Youth disability supplement if your spouse received disability support pension

- carer payment paid under Part 2.5 of Social Security Act 1991

- invalidity service pension paid under Division 4 of Part III of the Veterans’ Entitlements Act 1986

- partner service pension paid under Division 5 of Part III of the Veterans’ Entitlements Act 1986.

Make sure you include only your spouse’s exempt pension income.

Do not include at this field any of the exempt payments listed at Other specified exempt payments your spouse received.

Your spouse’s reportable superannuation contributions

Enter the sum of amounts shown on your spouse’s tax return at:

- Reportable employer superannuation contributions (in the Income tests section) and

- Personal super contributions (in the Deductions section).

Other specified exempt payments your spouse received

Enter the amount of the following tax-free government pensions your spouse received for 2020–21:

- a special rate disability pension paid under Part 6 of Chapter 4 of the Military Rehabilitation and Compensation Act 2004

- a payment of compensation made under section 68, 71 or 75 of the Military Rehabilitation and Compensation Act 2004

- a payment of the weekly amount mentioned in paragraph 234(1)(b) of the Military Rehabilitation and Compensation Act 2004

- a pension for defence, peacekeeping or war-caused death or incapacity or any other pension granted under Part II or Part IV of the Veterans’ Entitlements Act 1986

- income support supplement paid under Part IIIA of the Veterans’ Entitlements Act 1986

- Defence Force income support allowance paid under Part VIIAB of the Veterans’ Entitlements Act 1986.

Do not include these amounts at Your spouse’s exempt pension income.

Your spouse’s target foreign income

Enter the target foreign income your spouse received during 2020–21. Your spouse’s target foreign income is:

- any income earned, derived or received from sources outside Australia for your spouse’s own use or benefit that is neither included in your spouse’s taxable income nor received in the form of a fringe benefit, or

- periodic payments or benefits by way of gifts or allowances from a source outside Australia that are neither included in your spouse’s taxable income nor received in the form of a fringe benefit.

Your spouse’s target foreign income includes any foreign income that is not taxable in Australia. You must include any exempt foreign employment income shown as Exempt foreign employment income (in the Foreign income, assets and entities section) on your spouse’s tax return.

All foreign income must be converted to Australian dollars before you enter the amount at Your spouse’s target foreign income.

Your spouse’s net losses from financial investments and rental property

Enter the sum of amounts shown on your spouse’s tax return at:

- Net financial investment loss (in the Income tests section) and

- Net rental property loss (in the Income tests section).

Child support paid by your spouse

Enter the total amount of child support your spouse provided to another person. The amount of child support provided is the total amount of any payments or benefits that your spouse was required to pay or provide to another person to maintain their natural or adopted child.

Do not include payments or benefits made or provided to you by your spouse unless you live apart on a permanent or indefinite basis.

Your spouse’s taxed element of super lump sum for which the tax rate is zero

If your spouse was aged between preservation age and 59 years old, enter the taxed element amount of superannuation lump sums, other than a death benefit, your spouse received during 2020–21 that did not exceed your spouse’s low rate cap.

Other details

Consent to repay your spouse’s Family Assistance debt

If your spouse has a Family Assistance debt, do you consent to use part or all of your 2021 tax refund to repay it?

If you do not consent to use part or all of your 2021 tax refund to repay any Family Assistance debt of your spouse, answer No.

If you do consent, read below.

Answer Yes only if all of the following apply to you.

- You were the spouse of a family tax benefit (FTB) claimant or the spouse of a child care assistance claimant on 30 June 2021 and your income was taken into account in their claim.

- Your spouse has given you authority to quote their customer reference number (CRN) on your tax return (if your spouse does not know their CRN, they can contact Services Australia).

- Your spouse has a Family Assistance debt due to Services Australia or expects to have a Family Assistance debt for 2021.

- You expect to receive a tax refund for 2021.

- You consent to use part or all of your refund to repay your spouse’s Family Assistance debt.

If you consent, answer Yes. You must enter your spouse’s CRN.

Your spouse’s lump sum payment in arrears

Did your spouse receive a lump sum payment in arrears during 2020–21 and is your combined income for Medicare levy surcharge purposes over $180,000 (plus $1,500 for each dependent child after the first)?

If your spouse did not receive a lump sum payment in arrears during 2020–21, answer No.

Answer No if:

- your spouse did receive a lump sum payment in arrears during 2020–21, and

- your combined income for Medicare levy surcharge purposes is not over $180,000 (plus $1,500 for each dependent child after the first).

Otherwise, answer Yes. You must enter your spouse’s address.